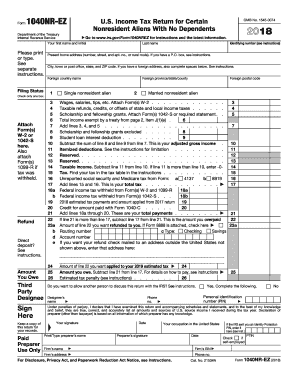

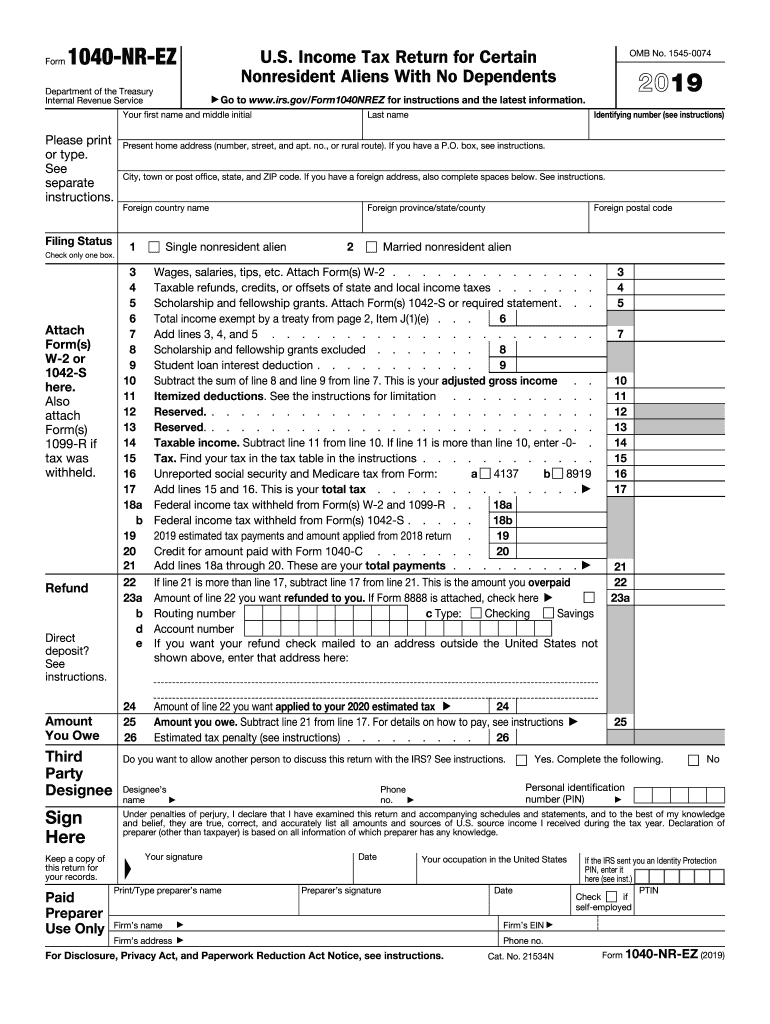

IRS 1040NR-EZ 2019-2026 free printable template

Instructions and Help about IRS 1040NR-EZ

How to edit IRS 1040NR-EZ

How to fill out IRS 1040NR-EZ

Latest updates to IRS 1040NR-EZ

All You Need to Know About IRS 1040NR-EZ

What is IRS 1040NR-EZ?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040NR-EZ

What should I do if I realize I've made a mistake on my IRS 1040NR-EZ after filing?

If you notice an error on your filed IRS 1040NR-EZ, you should file an amended return using Form 1040X. Ensure you clearly explain the corrections and submit the amended form to the appropriate IRS address. It's important to act promptly to rectify any mistakes to avoid potential penalties.

How can I track the status of my IRS 1040NR-EZ submission?

To track the status of your IRS 1040NR-EZ, you can use the IRS 'Where's My Refund?' tool available on their website. This allows you to verify if your submission has been processed and provides updates on your refund status. Ensure that you have the necessary information, like your Social Security number and filing status, ready for access.

What are some common errors that filers make with the IRS 1040NR-EZ?

Common errors with the IRS 1040NR-EZ include mathematical mistakes, incorrect amounts reported, and failing to sign the form. To avoid these pitfalls, double-check all entries, ensure you're using the correct form versions, and review instructions to ensure compliance with filing requirements.

What are the requirements for e-signing the IRS 1040NR-EZ?

E-signatures on the IRS 1040NR-EZ are generally acceptable if you meet specific criteria, such as using a software that complies with IRS e-filing standards. Make sure to retain proper documentation for your e-signature, which may be required if the IRS requests it during an audit.

What steps should I take if I receive a notice from the IRS regarding my 1040NR-EZ?

If you receive a notice from the IRS concerning your IRS 1040NR-EZ, carefully read the content of the notice to understand the reason. Gather the necessary documentation to support your position, and respond promptly to the request, as unaddressed notices can lead to additional penalties or audits.